It can be hard to find or keep employment right now. If you are struggling, you aren’t alone. In many ways, this is the worst job market in recent memory, and you can expect that things are going to take a while to recover. Well, what do you do in the meantime? If being unemployed or underemployed isn’t an emergency, then what is?

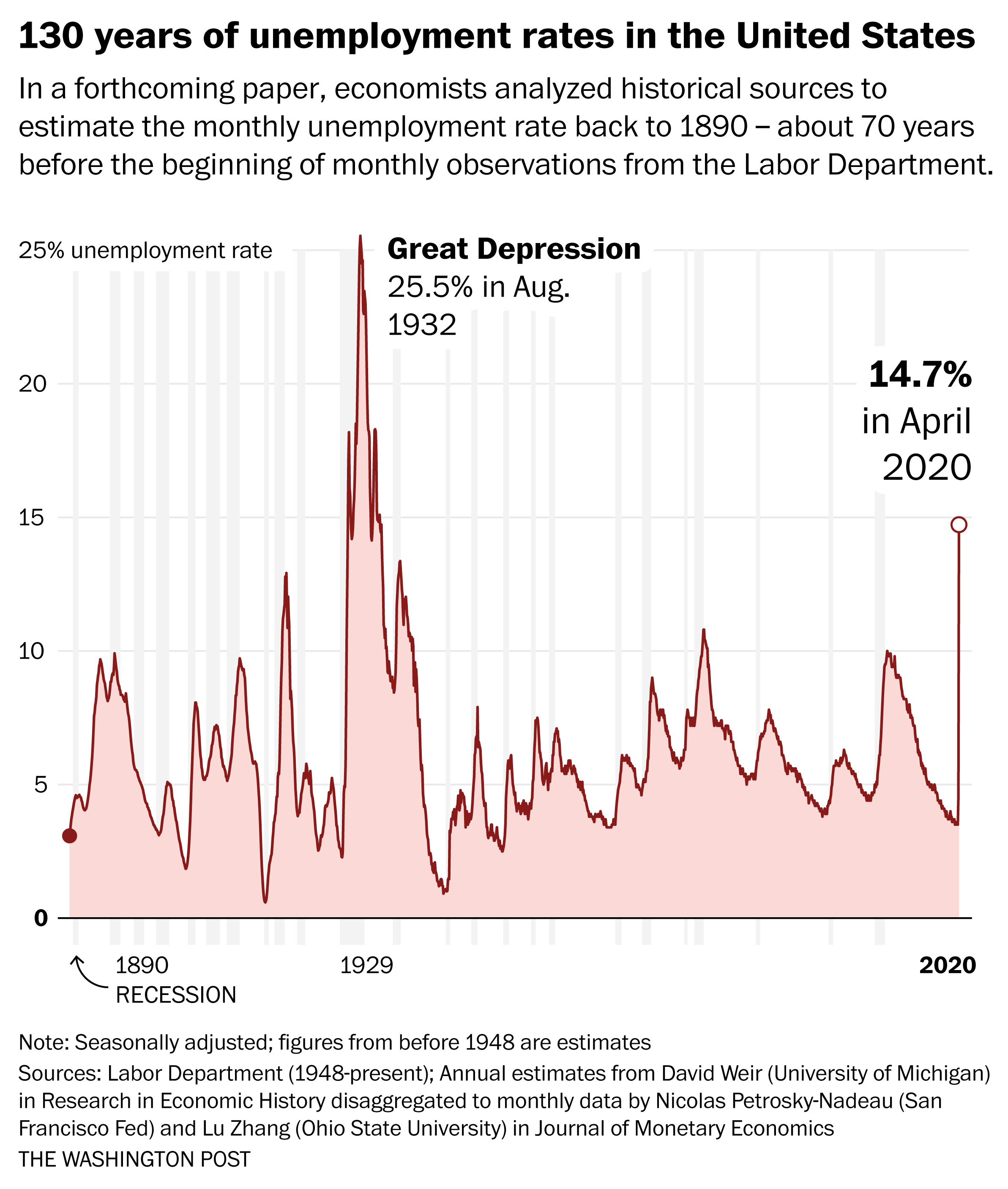

So we are living through a time which our economy hasn’t seen in more than 90 years. And while the numbers above are an estimate (and don’t reflect the somewhat better news that came with the May report) the general story is still true: lots of Americans who want to work right now cannot. And they need support. Maybe you are one of them. What do you do?

Well, your first step in unemployment insurance. Unemployment insurance was created by states in response to the Social Security Act of 1935 with the idea being that those who have jobs and pay into the system would then be able to draw from the system for retirement and for periods of unemployment. Employers also pay into the system for each employee they hire so that there is a collective coverage of risk. Each state runs their own program, and in this era of COVID-19, the Federal government has added additional limited support for those who have been temporarily furloughed or laid-off during this time. Under these temporary measures, even those who might not have qualified for unemployment benefits in the past (like those self-employed, or independent contractors) might be eligible.

What we’ve all seen is how unprepared many of our state unemployment systems were for the huge numbers of filers who needed to use their system. If you have been stuck, don’t give up. Persistence pays off (as does being up and active on your computer at about 8:00 in the morning, or trying on a Thursday or Friday). Remember also that filing for unemployment is not a one-time thing; you will likely need to log in weekly or every two weeks to refile.

While unemployment can be a helpful tool to cover some expenses during a time of uncertainty, it likely will be of short duration and (without the CARES additional benefit) will most likely leave you short from your previous income. So what’s next?

You may qualify for SNAP. SNAP (or Supplemental Nutritional Assistance Program, often referred to as Food Stamps) is a program to assist with the purchase of food for those who qualify. Again, rules are determined by the state in which you live and you apply using their application. During the COVID-19 pandemic, some states have been increasing the amount of the benefit payments for families with children due to the suspension of many free or reduced school lunch programs.

If you need help with Health Insurance, you may qualify for Medicaid. Medicaid is a program that helps families and individuals with health insurance if they have a low income that qualifies. Medicare is for those who are 65 years of age and older and provides health insurance coverage for qualifying adults. While the names may sound the same, they are very different programs, so make sure you know which one you are trying to obtain.

Once you secure help from the Federal Government and your state or local government, what’s next? Many local charities provide many different kinds of assistance, from food and clothing to shelter and employment. Some schools have updated their web pages to share local resources for assistance (see Valencia College and USF’s Food Panty page as examples).

Emergency situations happen, and if you are still a student enrolled on campus and you need assistance, reach out to Counseling, Advising, or Financial Aid. Chances are that your school has an Emergency Financial Aid program which can help with urgent situations. And make sure you check in to see if you can apply for CARES funds if you haven’t already (and if your school hasn’t already distributed its allocation).

What other resources have you found helpful in the case of emergency? One way to make sure you protect yourself from emergencies in the future is to start a savings plan. Next time we are going to start talking about one of the best ways to save for future spending needs – retirement savings.