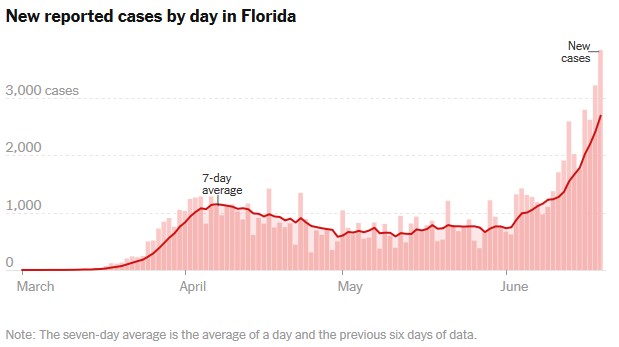

The past few days have seen a series of records for highest number of new cases of COVID-19 in Florida. Each day the curve rises, and the picture is fairly clear: we have not yet hit a plateau of cases in Florida.

At the same time, many colleges and universities (in Florida, and indeed all over the country) are beginning to announce their plans for Fall. Among others, UF and FSU have announced plans that will bring students back to campus, although both schools plan to not require students to return to campus in large numbers after Thanksgiving. Other schools, like Stetson University and the University of Tampa, have announced changes to their Fall calendars (either delays in opening, or moving up opening) to allow for a modified Fall semester. And finally, some schools like Valencia College and St. Petersburg College have announced that they will have a very limited number of classes on site in the Fall, and that most classes will remain online.

There are as many colleges and universities as there are plans for reopening. In part this is due to a lack of a clear sense of what’s coming for us in this pandemic, and – at the same time – students seem to be picking up on this confusion. In a recent study conducted by the Florida College Access Network, 42% of current college students surveyed indicated that their plans have changed for their education past high school; some are taking a semester or a year off, some are starting sooner than planned, and some are transferring to another school. At the same time, nearly 1 in 4 parents of high school juniors and seniors indicated that their children’s plans for life after high school have changed: 31% have postponed their plans, 27% have switched to an option closer to home, and 22% have switched to a less expensive option.

At the same time, the survey reveals that those with a high school degree or less are the most impacted by the economic difficulties that have come along with the pandemic. 64% of those with a high school diploma or less reported job loss, pay cuts, or reduced work hours, while at the other extreme, only 50% of those with a bachelor’s degree (and 40% of those with a master’s) reported the same difficulties.

In this environment, a focus on health matters. There is a correlation between job loss and education level (and the ability to telework), and we know that social distancing is the best way to control spread. We also know that health insurance can make a difference when a test is medically necessary. But what is health insurance? Why do you need it? What if you can’t afford it? And why did so many candidates for President argue about it?

Health insurance is another kind of protection for situations that you aren’t expecting. While we won’t go through every different kind and option of health insurance today (you can read more about all of this here), we do want to look at two options: employer-sponsored health insurance and the Affordable Care Act (also called the ACA or Obama-care).

The law changed in 2010, and children can remain on their parents’ insurance plans until they are 26, so chances are many of you are covered by your parents, but once you turn 26 you will need to find your own coverage.

Generally a health insurance plan will require you to pick a primary care physician. This doctor will coordinate care for you and help you find specialists when more advanced care is required. The benefit of a health insurance plan is that you will have coverage in case things go wrong with your health (without insurance you may have to pay a large amount for your care). The downside of health insurance is that you often can’t just see who you want without getting approval first through your Primary Care doctor.

In addition, many health insurance plans have co-pays, deductibles, co-insurance, and maximum out-of-pocket costs. What are all of these?

- A co-pay is the amount you will pay immediately out of pocket to see a doctor or specialist. The amount varies by your plan, but generally runs between $10 and $50 per visit depending on the level of specialty, or could be up to $100 or more for an emergency room visit.

- A deductible is the amount of money in total that must be paid for health care services before your insurance covers your expenses. Usually the deductible does not apply to your primary care physician visits but to other types of care.

- Co-insurance kicks in after your deductible. This is a percentage of costs that you must pay as your insurance pays the other portion. For example, if your plan has a co-insurance requirement of 20%, then you pay that 20% of the cost and the insurance company pays the other 80%. This will hold true until you pay your out-of-pocket maximum.

- An out-of-pocket maximum represents that maximum total cost you will have to pay before your health insurance will cover 100% of any remaining costs for you.

All of these reset each year, so it is important to understand where you are as you plan your care. As an example, let’s say that you are in an accident and require hospitalization for a week. The bill arrives and with medical care, surgery, anesthesia, and all other expenses, the total cost is $110,000. Usually your health insurance has negotiated rates which are better than the regular rates you would get if you walked off the street without insurance, so let’s say this drops immediately to $65,000 because of these negotiated rates. Your insurance has a $100 co-pay for Emergency Rooms, $500 deductible, a 20% co-insurance, and a $5,500 maximum out-of-pocket. Well, you would have to pay the $100 co-pay and then the $500 deductible which is $600. The remaining cost is $64,400 and 20% of that is $12,880 which is way above your maximum out-of-pocket. Since you already paid a $100 co-pay, and a $500 deductible, your maximum additional cost would be $4,900 (your $5,500 max minus $600 already paid). In this case you would have paid a total of $5,500 for the equivalent of $110,000 worth of care. Good thing you had health insurance. In addition, any additional expenses you had for the remainder of your coverage year would be covered at 100% because you have already paid your maximum out-of-pocket for that year; this would all reset the next year when your coverage begins again.

Of course, the other way you pay for insurance is when you pay your monthly premiums. Health insurance is not free although some employers may pay some, part, or all of your monthly costs. If you have an employer-offered health insurance program, chances are that your employer is paying a significant part of the cost for you as a benefit. In addition, any amount you pay as a monthly premium is deducted from your salary prior to paying taxes, so you get to count this as tax-free income.

There are other ways to save money on health care expenses like Health Savings Accounts and Flexible Spending Accounts, and we will cover these at another time.

What if you aren’t working or you want to look at other options? The healthcare.gov site provides information on the plans that are available through the ACA, and could be less based on your income and family size. Take a look because as you know now, we always want to protect ourselves against the unexpected.

Speaking of expecting the unexpected, what is your college or university planning to do regarding reopening? Are you changing your educational plans this fall? Or are you adopting a “wait and see” approach? Moneyman want to know, so clue me by adding your comments at the top of the post!

The other thing to consider is in-network vs. out-of-network providers. Some plans require members to choose from a set of providers to get full (or in some cases, any) coverage. Premiums for plans that utilize networks are typically less expensive than those without networks. Many options to consider when shopping for healthcare insurance.

LikeLike