Let’s face it. Verification isn’t fun. When you are selected for verification, it can feel like a burden, and it may feel like those of us who are working in financial aid are trying to “get into your business”. Trust moneyman, it isn’t our choice. If you are selected for verification it might feel like the flip of a coin at random (heads or tails?), but once you have been selected there are certain principles we need to follow.

One of these principles is that while financial aid officers are not accountants, we do need to know some basic tax information. Federal Student Aid publishes an annual Application and Verification Guide for financial aid administrators (which is very technical, feel free to read it if you have nothing better to do) which perhaps says it best:

Financial aid administrators do not need to be tax experts, yet there are some issues that even a layperson with basic tax law information can evaluate. Because conflicting data often involve such information, FAAs must have a fundamental understanding of relevant tax issues that can considerably affect the need analysis. You are obligated to know (1) whether a person was required to file a tax return and (2) what the correct filing status for a person should be.

Page 132 of the 2020-21 AVG

So here we go. Let’s start with Heads… In this case, Heads of Household.

If moneyman sees one common mistake that holds up families from completing verification, it is both parents filing their tax returns as head of household even though they are married and living together. The rules for filing Head of Household (as published by the IRS) say:

“You may be able to file as head of household if you meet all the following requirements:

- You are unmarried or “considered unmarried” on the last day of the year…

- You paid more than half of the cost of keeping up a home for the year.

- A qualifying person lived with you in the home for more than half the year (except for temporary absences, such as school). However, if the qualifying person is your dependent parent, he or she doesn’t have to live with you. See Special rule for parent, later, under Qualifying Person.”

If two parents file as married on the FAFSA as their marital status and then provide separate tax returns with one or both filing as Head of Household, this is usually a problem. To correct this, the family either needs to prove that they meet the qualifications above, or they need to file an Amended Tax Return. Otherwise we cannot complete verification.

Why would a family want to file as Head of Household? Usually tax rates are lower, so amending a return may mean that the family needs to pay more in taxes, but to qualify for aid it is necessary to resolve this discrepancy. There could be a possible reason for a parent to file Head of Household on a tax return (say for the 2018 tax return), but file the FAFSA as “married” for 2020-21, but the situation is unlikely. Lots of examples (and much more detail) can be found at this link.

More T(r)ials (or trials) of verification:

The quote above also mentions that financial aid administrators should kow if a parent or student should have filed a tax return (if they earned enough income to be required to do so).

How does this work? The same IRS publication lists the minimum income thresholds which require a taxpayer to file a Federal income tax return.

According to the chart, if a regularly employed (not self-employed) individual earns above 12,000 (and they are single and under 65), they must file a tax return. Of course, a taxpayer might choose to file anyway so that they can get their tax refund, but the above chart represents the numbers of income at which you must file a return. Note (by the way) that spouses who file separately have a very low income threshold – only $5.

Self-employed individuals have even a lower threshold. If you are self-employed and your net earnings are greater than $400, you need to complete a tax return.

Sometimes we hear from students whose parents do not file a tax return because they don’t believe they have to. In these cases, we are required to collect copies of W-2s, and “non-filer” from the IRS to show that the taxpayer did not file a tax return. But if the income is above the minimum income threshold, we must have a tax return.

Here are the trials of verification. What stories have you experienced? Where do you get hung up in verification?

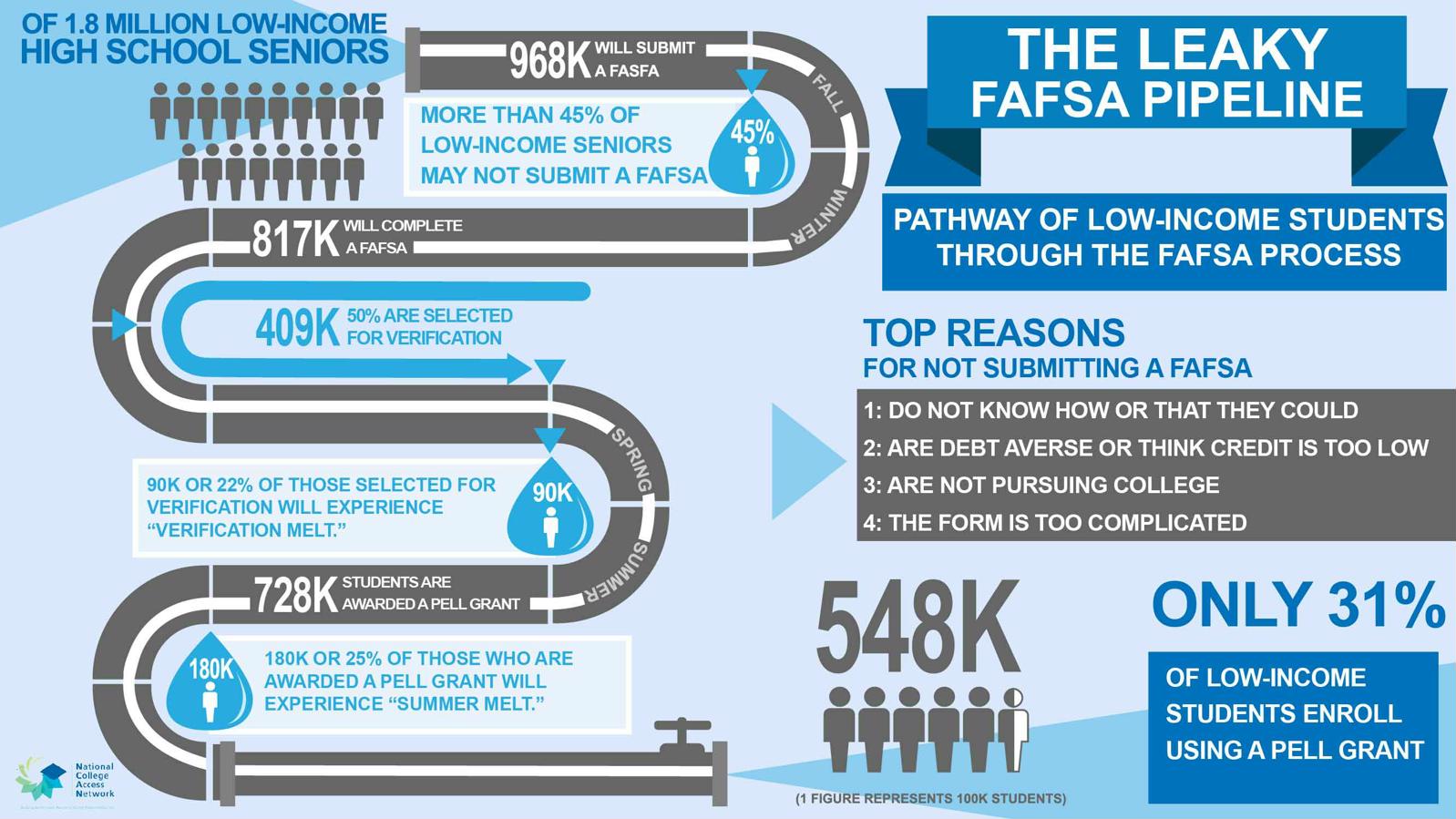

NCAN (the National College Attainment Network) in 2017 published a study of the leaky FAFSA pipeline. According to their study, 22% of applications selected for verification drop out due to the difficulty of the process.

Don’t be part of the melt! Ask your verification question here and moneyman will help!! Don’t leave your financial aid unclaimed! Be “cool” (don’t be part of the summer melt) and don’t “flip”!