How to Successfully Change Your Student Loan Repayment Plan

Student Loan Planner

NOVEMBER 7, 2023

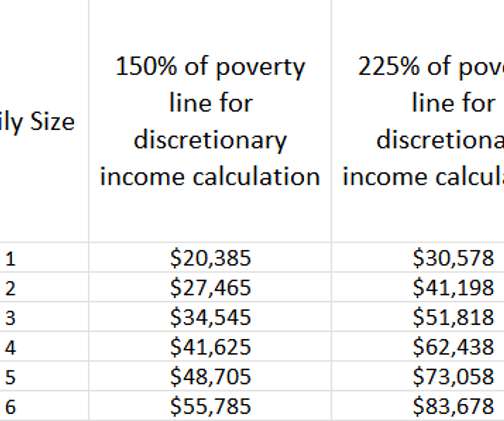

If you’re readjusting to making monthly federal student loan payments again, you might consider getting on a new repayment plan. You can change your student loan repayment plan whenever you want, at no cost to you. Department of Education.

Let's personalize your content