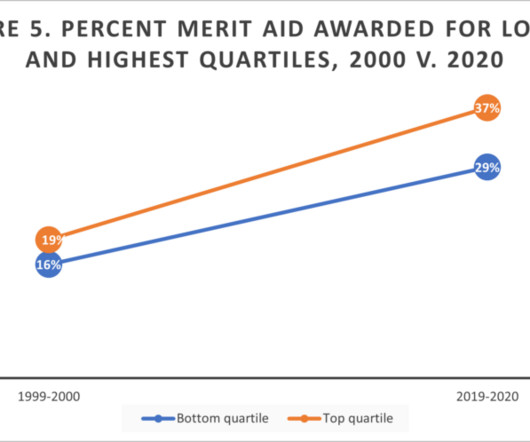

Unequal Distribution

NACAC's Admitted

OCTOBER 10, 2023

However, the rising costs of college are increasingly out of reach for many students. Financial aid discussions have centered on simplifying FAFSA and increasing federal Pell Grants – all important – but federal student aid policies are only one funding source for families trying to determine how to pay for college.

Let's personalize your content