Senators Reintroduce Bills to Help Inform Students about College Loans and Financial Aid

Diverse: Issues in Higher Education

MARCH 1, 2023

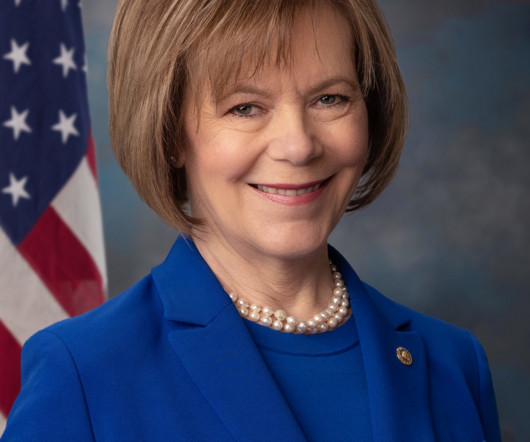

Tina Smith The bills aim to make sure that students are informed and educated about college search and selection, loans, and financial aid. The Understanding the True Cost of College Act would create a universal financial aid offer form and standardize terms used in financial aid.

Let's personalize your content