Sanders, Jayapal Introduce New "College for All Act" to Eliminate Tuition for Most Students

Diverse: Issues in Higher Education

MAY 21, 2025

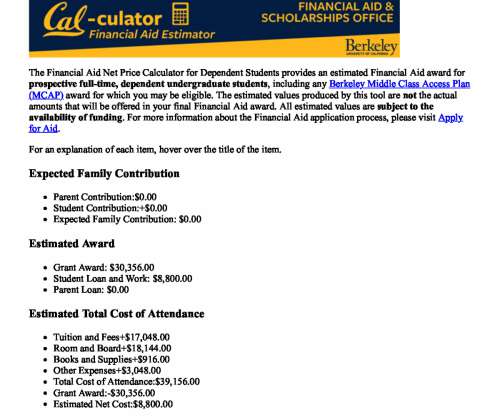

introduced legislation Wednesday that would make public colleges and universities tuition-free for approximately 95% of American students, in what supporters call the most significant higher education investment in six decades. Jayapal highlighted the legislation's focus on addressing educational inequity. history."

Let's personalize your content