Last Chance for Many to Get More Credit Toward Student Loan Cancellation

NCLC Student Loan Borrower Assistance

APRIL 24, 2024

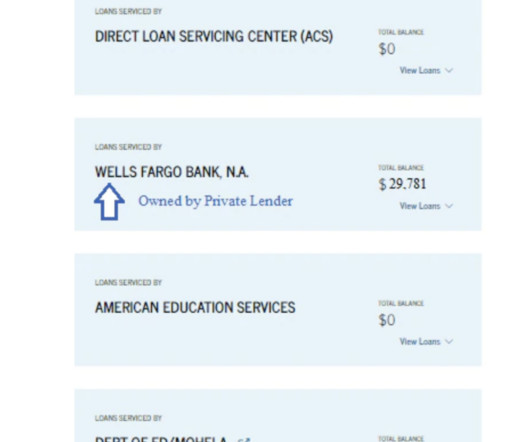

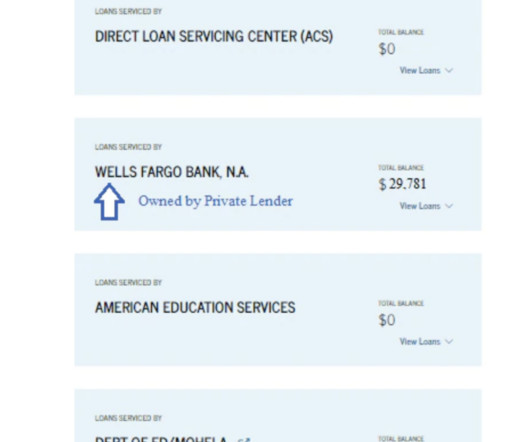

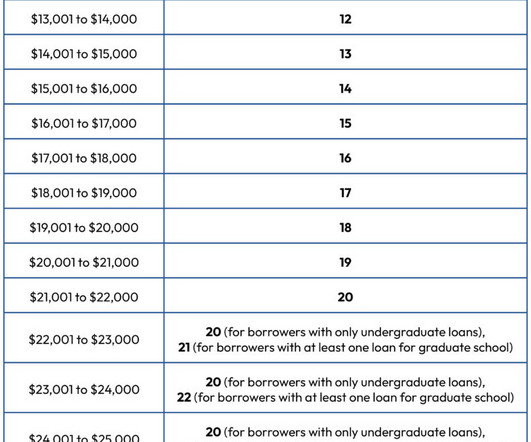

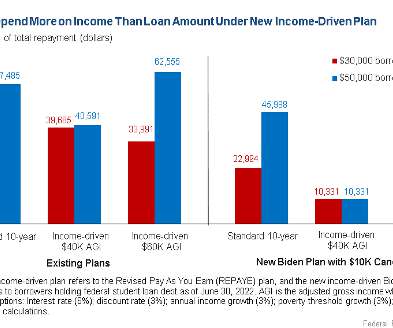

The deadline to apply to consolidate many older federal student loans to be included in the one-time payment count adjustment is Tuesday, April 30th. Do I need to consolidate my loans to get additional credit toward debt relief? I have loans I need to consolidate – what do I do next?

Let's personalize your content