How Inflation Impacts Student Loan Borrowers

Student Loan Planner

DECEMBER 12, 2022

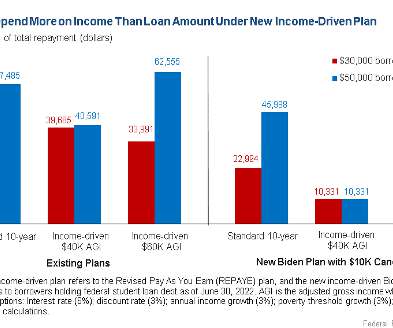

So it’s fitting that we’ve seen inflation in 2022 higher than any time since 1980. This impacts you as a student loan borrower in a number of different ways depending on the type of repayment approach you’re taking with your loans. If you’re careful, […].

Let's personalize your content