Pell Grant Increase Will Help Low-Income Students, But More is Needed

Diverse: Issues in Higher Education

JANUARY 4, 2023

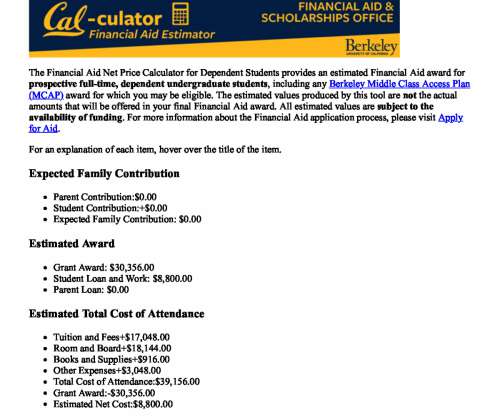

29, the new federal spending plan is set to increase the Pell Grant in 2023, allowing low-income students a chance to access up to $7,395 each year. According to the Department of Education, about six million students received Pell Grant funding in the 2020 – 2021 academic year. The total student loan debt reached $1.75

Let's personalize your content