A New Parent PLUS Loan After Double Consolidation? A Parent’s Guide to Access More Funding

Student Loan Planner

APRIL 5, 2024

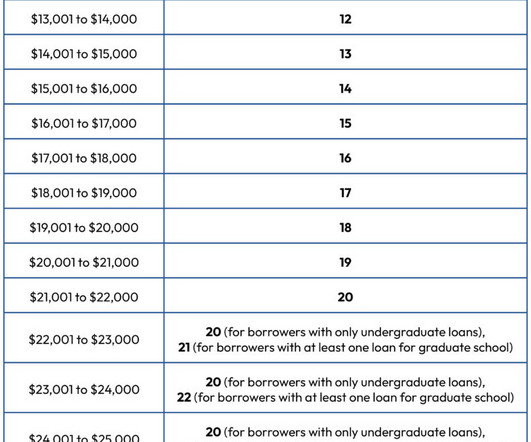

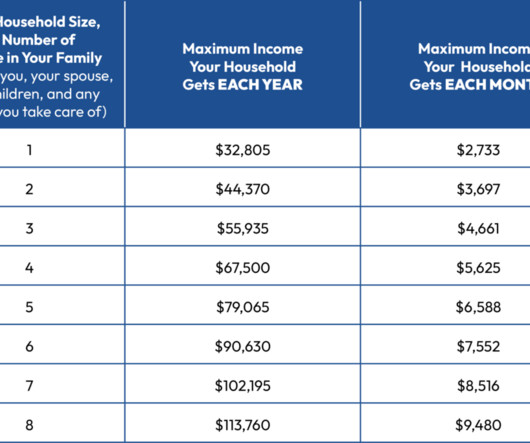

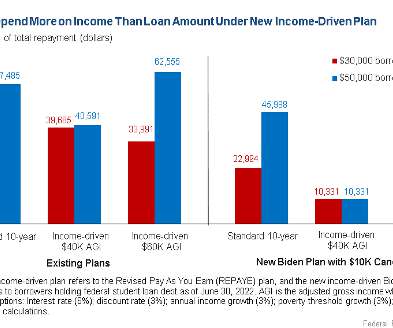

As a Parent PLUS loan borrower who successfully completed the double-consolidation loophole you’ve unlocked more affordable repayment plan options like IBR, PAYE, or SAVE. The… The post A New Parent PLUS Loan After Double Consolidation?

Let's personalize your content