3 Major Student Loan Shakeups That Impact Forgiveness and Repayment

Student Loan Planner

MAY 10, 2024

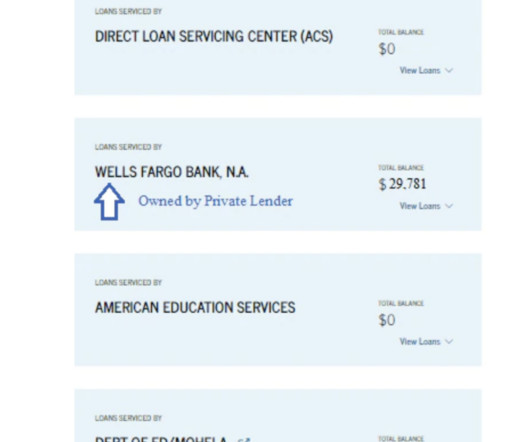

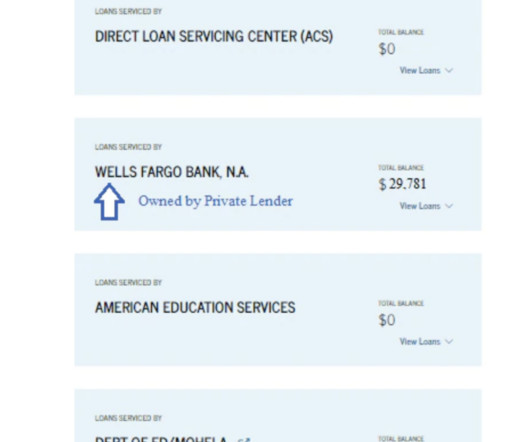

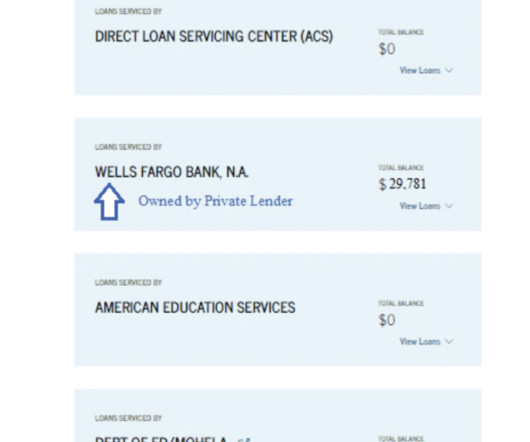

Student loan borrowers have been experiencing significant turbulence, with the landscape constantly shifting beneath their feet. New student loan forgiveness and repayment programs, many with complicated eligibility criteria and disparate timelines, offer borrowers opportunities for relief and confusion.

Let's personalize your content